vat refund paris chanel | Paris france vat refund schedule vat refund paris chanel For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a convenience fee for processing the VAT refund for you. DOBELES PILS. Sveicināti Dobeles novadā! Atvērts 24h Audio gids Maršruti Dobeles novada pasākumu plāns 2024. Aktualitātes. "Zemgale aicina" tūrisma jaunumu avīze Bērnudārza izlaidums LVM dabas parkā Tērvetē Tūrisma uzņēmēji līdz 1. jūnijam aicināti pieteikties, lai iegūtu vides kvalitātes zīmi “Zaļais Sertifikāts” Skatīt vairāk. Pasākumi.

0 · where to get a vat refund

1 · vat refund Paris 2024

2 · how much is the vat refund

3 · gare de lyon vat refund

4 · france vat refund

5 · Paris train station vat refund

6 · Paris france vat refund schedule

7 · Chanel goyard vat refund

Can I buy car insurance when I'm overseas? Yes. If you're abroad, you can arrange car insurance online or if you'd like to speak with someone, phone + 441202955682 and we'll direct your call to the right place.

For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a convenience fee for processing the VAT refund for you.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your .Planning a trip to Paris and considering making a purchase over there because of the VAT refund I have been hearing so much about. Does anyone know whether the tag price includes tax? . Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be .

Lift Paris shopping with our guide on how to get a VAT refund. Learn the steps for tax-free in Paris, from eligibility & shopping to claiming a refund.By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax .

So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my . Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT .

For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a convenience fee for processing the VAT refund for you.

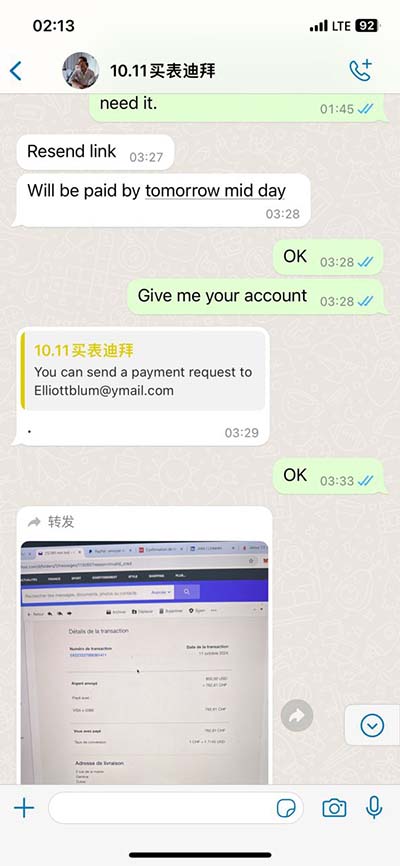

The Vat Tax refund on average takes 30–90 days to process. If you are traveling to Paris and go shopping during the busy season, I've seen the refunds take 6 months. If you are traveling to Paris and go shopping during the off expect, expect to receive your refund quickly. If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your VAT refund. To claim your VAT refund at Chanel in Paris, follow these steps:

Planning a trip to Paris and considering making a purchase over there because of the VAT refund I have been hearing so much about. Does anyone know whether the tag price includes tax? And if you have done this before, how much did you save? Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it! Lift Paris shopping with our guide on how to get a VAT refund. Learn the steps for tax-free in Paris, from eligibility & shopping to claiming a refund.By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.

So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my goodies, and when I left the EU via UK I got my VAT forms stamped and either refunded there or . Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at . For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet Tax Free take a big chunk out of it as a convenience fee for processing the VAT refund for you.The Vat Tax refund on average takes 30–90 days to process. If you are traveling to Paris and go shopping during the busy season, I've seen the refunds take 6 months. If you are traveling to Paris and go shopping during the off expect, expect to receive your refund quickly.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your VAT refund. To claim your VAT refund at Chanel in Paris, follow these steps:

Planning a trip to Paris and considering making a purchase over there because of the VAT refund I have been hearing so much about. Does anyone know whether the tag price includes tax? And if you have done this before, how much did you save? Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it! Lift Paris shopping with our guide on how to get a VAT refund. Learn the steps for tax-free in Paris, from eligibility & shopping to claiming a refund.By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.

So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my goodies, and when I left the EU via UK I got my VAT forms stamped and either refunded there or .

where to get a vat refund

court of richmond henry tudor

312.527.3896. And get a $40 Bonus Note as a new Nordstrom credit cardmember. Restrictions apply. Apply Now. Find a great selection of Shop Louis Vuitton Online at Nordstrom.com. Top Brands. New Trends.

vat refund paris chanel|Paris france vat refund schedule